At Mowery & Schoenfeld, our Transaction Advisory Services practice focuses on deals in the lower middle-market, which we define as companies between $1M and $10M of EBITDA. About 80% of our engagements support buyers of these businesses by providing quality of earnings assessments, transaction structuring, and other related advisory work. The one area most consistently misunderstood between buyers and sellers is how to address net working capital.

In 2022, we conducted the inaugural Lower Middle-Marketing Working Capital Survey Report. Our goal was to understand how sell-side advisors approach working capital in their transactions to gain insight into diversity in viewpoints and offer suggestions on the treatment of net working capital.

What is net working capital?

Net working capital is a measure of a company's ability to meet its short-term financial obligations. It represents the difference between a company's current assets (including cash, accounts receivable, and inventory) and its current liabilities (including accounts payable and short-term debt). A positive net working capital means the seller has more current assets than current liabilities. In laymen’s terms, net working capital determines if the seller has enough money to cover operations and pay the bills.

Net working capital is an important indicator of a company's financial health and its ability to manage its short-term financial obligations. It is also an important consideration for lenders and investors when evaluating a company's creditworthiness and investment potential.

For various reasons, net working capital’s importance and impact is often misunderstood between Buyers and Sellers. Some of the transactions we are involved with are proprietary in nature, such as when the Buyer reaches out directly to the owner of the business and negotiates the purchase and terms. In those situations, there is no sell-side advisor (investment banker or broker) assisting the seller with understanding the process. In this situation, our team expects some disagreement or further education required before both parties come to an understanding. In other situations, however, there is a sell-side advisor, yet there continues to be fundamental misunderstandings of the typical market terms for net working capital.

Who did we hear from?

For this survey, we identified sell-side advisors (investment bankers, business brokers, and other related professionals). We then looked at the typical market in which they focus and how they typically educate their clients on what acceptable terms for working capital should include. We eliminated any respondents without experience in the lower middle-market and specifically representing business owners seeking to sell their business.

The majority of participants had 10 years or less of experience and typically represent less than 10 sellers per year. Not surprisingly given current market conditions, these deals were primarily in the services, distribution, and manufacturing industries. Of the industries sold, Services, Manufacturing, and Distribution were the top three recurrent industries. Our respondents worked on approximately one transaction per month and had an average of 23 years of experience.

Key Challenges

As you can imagine, one of the challenges both Buyers and Sellers face is a lack of financial data. In our survey, respondents stated that in only one fourth of their deals did the Seller undergo an external audit or review. This lack of clean, historical financial data can make it more difficult for parties to agree on the net working capital calculation, which obscures the understanding of the company’s overall financial health.

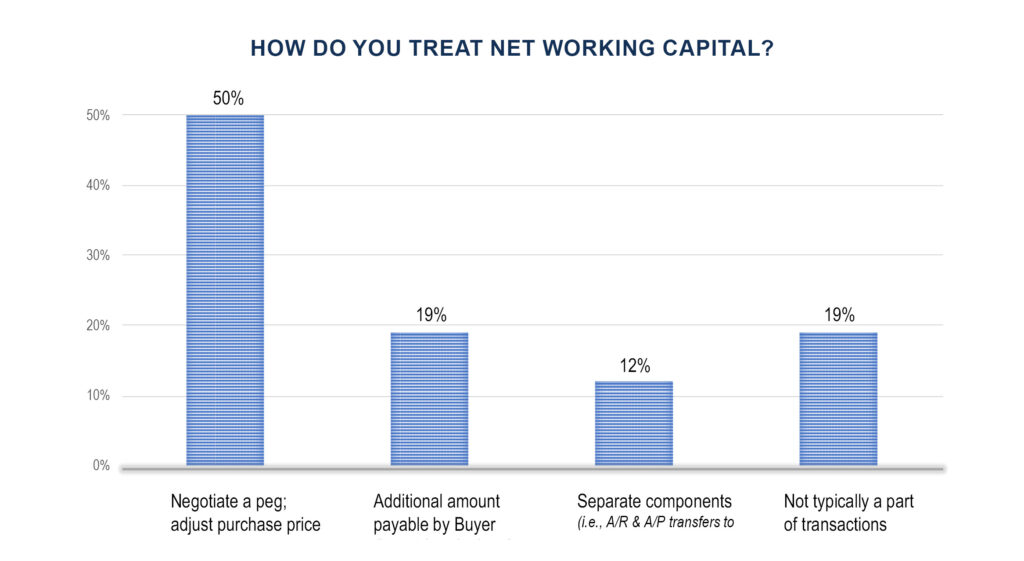

Based upon our experience with transactions in this size range, we anticipated a range of responses with how working capital is viewed and positioned by sell-side advisors. The responses largely confirmed our expectations: there is a group of sell-side advisors that approach working capital in the customary manner, and another who views working capital to be something additive to the overall value of the business.

When asked about the companies they represented, over half reported treating working capital as either an addition to the valuation of the business, as a separate component of the transaction entirely, or completely excluded. These three alternatives are counter to the typical treatment of middle market transactions and represent an expectation gap between buyers with backgrounds in those middle market deals and the sellers with whom they are negotiating.

Best Practices

While the goal of our survey was to report on current activity in lower-middle market deals, we did want to share meaningful trends and takeaways that became apparent in our research.

Understanding the Levers

In the sale of a business, there are various levers that can be used to negotiate the terms of the sale, including valuation, deal structure, timing, and due diligence.

Buyers will benefit from detailed modeling to understand the impact of NWC variability on operating cashflows. They should also educate themselves on the key contracts with vendors and customers, as well as understanding who is the decision maker in key sales and purchasing functions. Additionally, when there is a valuation gap between the Buyer and Seller in a transaction, Buyers should be prepared to backstop a valuation gap via structure.

For Sellers, not only should you be able to understand how you manage working capital, but you should also have a way to articulate this to the interested party. Be prepared to help Buyers understand what is a “normal” amount of working capital during any point in the business cycle or season.

Defining a Framework

By defining a framework in the sale of a business, you can plan, execute, and manage the sale process with a systematic and structured approach with a roadmap of all of the activities involved in the sale process, from conception to conclusion.

For buyers, reviewing the overall principle of working capital as early in the process as possible, even before an LOI is in place, will help to create a more realistic plan and timeline. With the seller, you should come to an agreement on whether or not working capital should have a material impact on the purchase price and set an expectation that—outside of unique performance circumstances—there should not be any surprises related to NWC at closing.

For sellers, having a strong sense of how your historical financial reporting is going to depict working capital trends needs to happen before your business is on the market. Cleanse the historical balance sheets of non-operating current assets and liabilities and review revenue recognition policies and determine if any deferred revenue liabilities will be at issue in the business cycle or season.

Communicating Early

For both buyers and sellers, the most important practice is to communicate early. As one of the most misunderstood concepts between buyers and sellers, NWC can cause deals to fall apart very late in the process. Both buy- and sell-side advisors should make it a point to discuss NWC openly and with specificity very early in the transaction process and confront difficult valuation conversations early—not at the end of the transaction.

Michael Kidd

Consulting Partner and Director of Transaction Advisory Services

Mike combines his analytical sensibility and curious nature to partner with clients. He strives to listen first and then presents thoughtful, personal, and pragmatic advice. His goal is to see problems from the client’s perspective and provide insights behind the numbers.

In over a decade with the Firm, Mike’s portfolio includes audit, attest, and advisory services to clients in various industries. He specialized in assisting Search Funds and their Entrepreneurs through the fund lifecycle, managing due diligence engagements, and consulting on mergers and acquisitions.