If your company wants to acquire another business, you will need to anticipate many challenges. To improve your chances of success, it is important to devote resources to intensive tax planning before your transaction closes.

During the purchase negotiations, you and the seller will likely discuss issues such as to what extent each party can deduct their transaction costs and the amount of federal, state, and local taxes due from the seller upon completing the transaction. In many instances, the seller and buyer have different objectives- the seller wants to pay as little tax as possible while the buyer wants to preserve the future tax benefits.

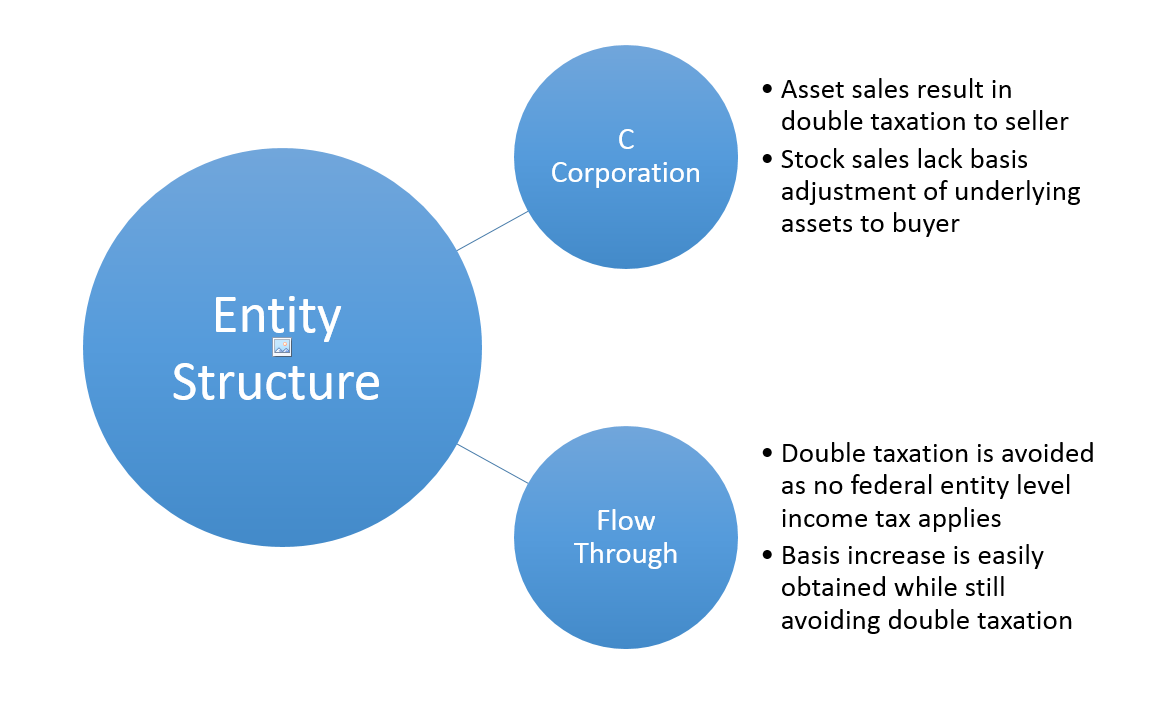

One primary consideration is the entity structure of the seller. If the seller conducts business in a C Corporation (a taxable entity) the seller will want to sell the stock to avoid being double taxed at the corporate level upon liquidation. Purchasing the stock of the company is disadvantageous to the buyer because there is no increase for the amount of the purchase price in the tax basis of the underlying assets of the business resulting in the loss of potential future tax deductions.

If the seller conducts business as a flow through entity such as an S Corporation or Partnership, the double taxation on the sale is avoided. It is then much easier for the seller to sell the assets of the business and much more favorable for the buyer, who will get an increased tax basis in the assets purchased based on the allocation of the purchase price.

Because of these factors, the entity structure of the seller is often a major stumbling block. The tax liability can be quite onerous to the seller if the transaction is an asset sale that is double taxed. There are some potential strategies to reduce this onerous tax burden such as allocations to a consulting or employment contractor structuring a noncompete agreement.

We recently advised on a transaction where the seller used a C Corporation. The tax structure of the seller proved to be a major obstacle as the seller had certain expectations about what he wanted to get out of the transaction. We were able to structure the transaction in a manner to reduce the seller's tax burden while generating long-term tax benefits to our client, the buyer. The most important point is that the tax status of the seller has to be factored into the buyer's analysis of the transaction. If the buyer is not going to get future tax benefits from increased tax basis in the assets purchase, then that is in effect a future cost that should be reflected in the purchase price.

It is really important to understand the seller's tax status as soon as possible so that you can consider this factor when analyzing the potential acquisition and considering making an offer to purchase.