With the release of a reconciled version of the Tax Cuts and Jobs Act (TCJA) from the House-Senate Conference Committee, we now have a better idea of how the final tax reform provisions will look.

As promised, here are a few key changes that are the most likely to affect you and your year-end tax planning. If you have any questions about the proposed changes and how you can plan for them, reach out to your M&S tax adviser.

Note: These provisions are set to sunset after 2025 unless specifically referenced below

Individual, Estate, & Gift Tax Considerations

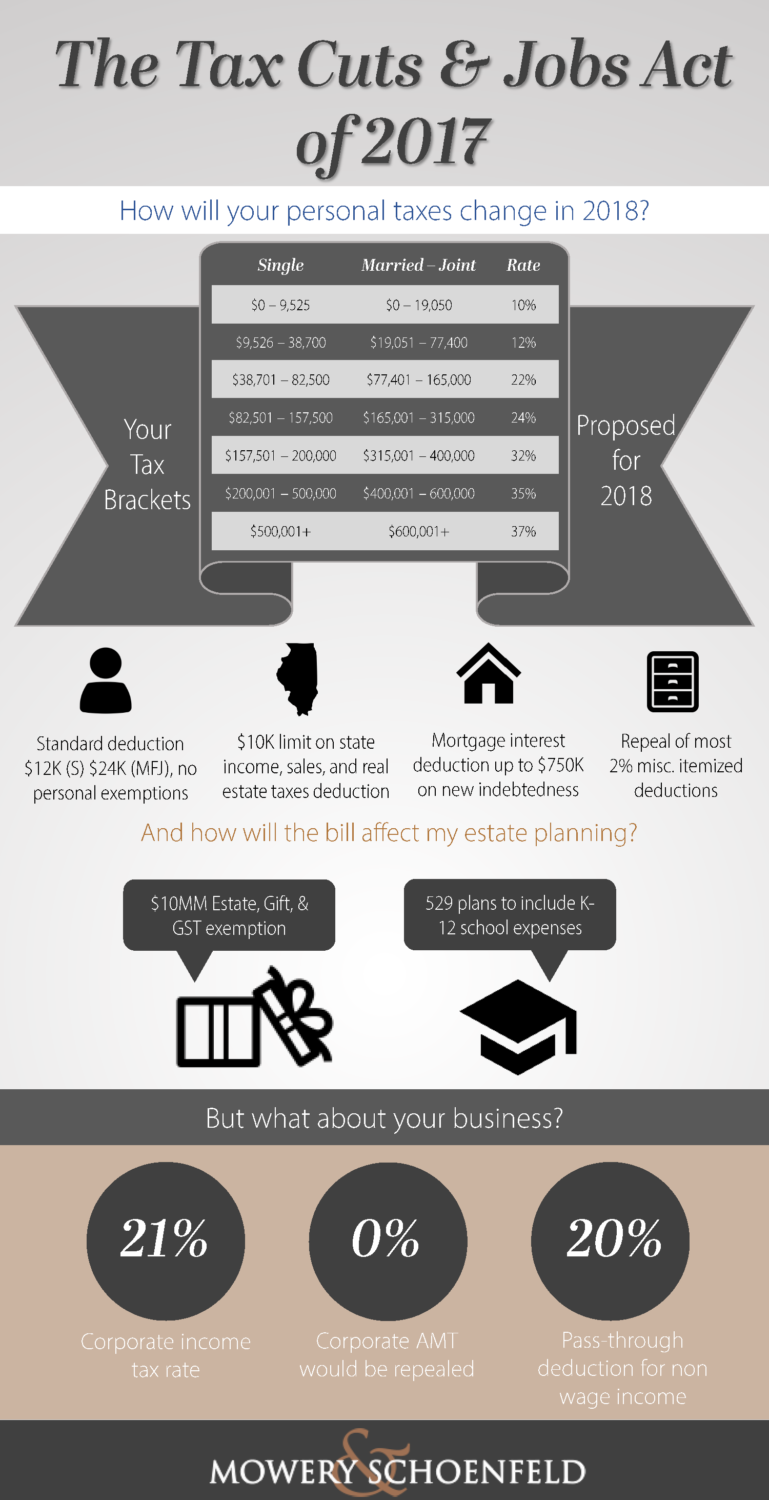

- Individual Income Tax Rates - The TCJA proposes seven individual tax rates, ranging from 10% - 37% effective 1/1/2018. The highest rate of 37% applies to single filers with taxable income greater than $500,000 and MFJ filers with taxable income greater than $600,000. You and your adviser should review current marginal tax rates vs. the proposed rates to determine whether acceleration/deferral of income/expenses is appropriate.

- Changes to Personal Exemption and Standard Deduction - The TCJA would repeal the deduction for personal exemptions. The standard deduction would increase to $12K for single filers and $24K for MFJ filers. If you currently itemize deductions and would claim the standard deduction in future years, you may want to consider accelerating itemized deductions to 2017, pending alternative minimum tax considerations.

- Limitation of State and Local, Sales, and Property Tax Deduction -The deduction for state, local, sales, and property taxes would be limited to a total of $10K. The plan also states that the prepayment of 2018 state and local tax paid in 2017 would not be deductible in 2017, but would instead be treated as an itemized deduction as of 12/31/2018. You should evaluate the opportunity to prepay state, local, and property taxes prior to year-end, pending alternative minimum tax considerations.

- Reduction on Acquisition Indebtedness Allowable for Mortgage Interest Deduction - Mortgage interest could be claimed on $750K of home acquisition debt incurred after December 15, 2017. Mortgages incurred on or before December 15, 2017 would be grandfathered under the $1MM home acquisition debt limit. The TCJA would also repeal the home equity interest deduction.

- Repeal of Most Miscellaneous 2% Itemized Deductions - The TCJA would repeal most miscellaneous 2% deductions including the deduction for investment management fees and tax preparation fees.

- 529 Education Savings Plans - 529 education savings plans would be revised to include K-12 school expenses.

- Increase in Estate, Gift, and GST Exemption - The TCJA would increase the estate, gift, and GST exemption amount to $10MM, indexed for inflation.

- The requirement to use the FIFO method for the sale of securities was not included in the TCJA - You will still be allowed to request specific tax lots for the selling and/or gifting of securities.

Corporate & Flow - Through Entity Tax Considerations

- Reduction in Corporate Income Tax Rate - The TCJA would permanently reduce the corporate income tax rate to 21% effective 1/1/2018. Corporate AMT would be repealed.

- Creation of 20% Pass-Through Deduction for the Non-Wage Portion of Pass - Through Income - The TCJA would create a new Code Section 199A that provides a maximum deduction of 20% for the non-wage portion of pass-through income. The calculations are complex and apply differently to "Specific Service Trade or Businesses." Please review these provisions with your M&S advisor to determine the tax planning opportunities available to you.