There is a great deal of speculation about the potential tax changes that will come from the Trump administration. The current proposals are, of course, subject to the legislative process and potential negotiation. The most recent proposals are summarized as follows.

Individual taxes:

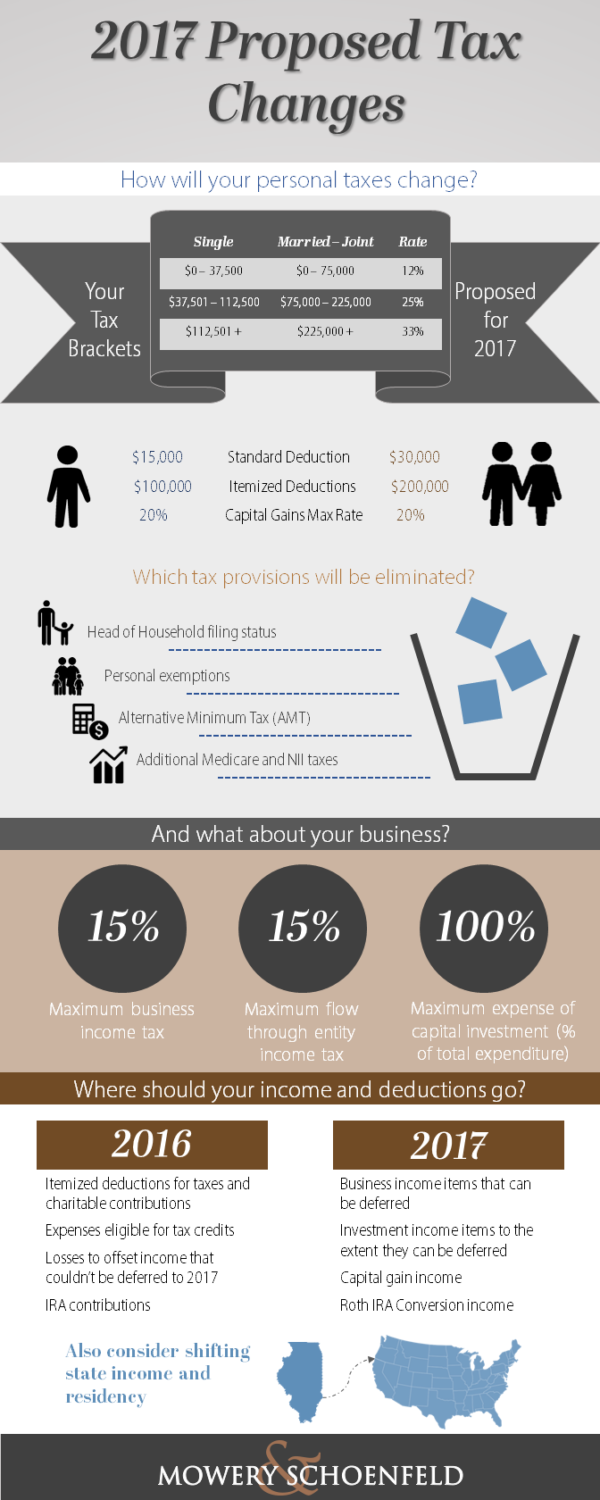

There are currently seven different tax rates ranging from 10% to 39.6%. The proposed individual tax rates would be as illustrated below:

Other changes for individuals include:

- The Head of Household filing status would be eliminated

- There would be no deduction for personal exemptions (currently $4,050)

- The standard deduction would increase to $15,000 for single persons and $30,000 for married couples filing jointly

- Itemized deductions would be capped at $100,000 for single persons and $200,000 for married couples filing jointly

- The capital gains tax rate would remain capped at 20%

- The alternative minimum tax (AMT) would be eliminated

- The additional taxes imposed by the Affordable Care Act (additional Medicare tax and Net Investment Income Tax) for high income tax payers would be eliminated

- Contributions to dependent care savings accounts would be allowed tax free up to $2,000 per year

Business taxes

There are also major changes in the way businesses are taxed on the table. These include:

- The maximum business tax rate would be reduced to 15%

- Manufacturers could elect to expense 100% of capital investment in exchange for foregoing the corporate interest deduction

- The marginal tax rate for passthrough entities would be capped at 15%, but there would likely be a carve out for passthrough entities engaged in personal services, such as accounting, law, and medicine.

Estate & other taxes

Additional proposed changes include the elimination of the carried interest strategy for investment funds, as well as providing incentives for companies doing business oversees to transfer funds back to the United States.

The new administration is also looking to make impactful changes to the estate tax regime - stay tuned for a guest blog post next week from Michael Deering, our Firm's segment leader in Estate, Gift, and Trust Taxation, detailing these potential changes and explaining how they could affect your year-end tax and estate planning.

What these changes mean for you

All of the above described provisions are proposals which will be subject to change. There was a good deal of support for many of these items before the election, especially reducing the corporate tax rates, making the likelihood for this change very high.

Assuming some or all of these changes do take place, here's a few planning strategies that you can keep in mind as you wrap up the 2016 tax year:

- Accelerate your deductions for income tax, property taxes, charitable contributions, etc. and your tax credits into 2016

- Accelerate your IRA contributions into 2016, and postpone your Roth conversion

- Consider postponing capital gains, dividend income, and business income until 2017

- Accelerate your losses to 2016 to offset gains and income that cannot be postponed

- Analyze your state income tax situation and consider shifting your residency

If you need assistance with re-strategizing based on these changes, Mowery & Schoenfeld offers a wide range of accounting services and highly trained tax accountants that can help!