As we approach the end of the year and the end of the tax planning season for 2016, there's a lot of speculation surrounding the possible changes in tax law for 2017. Tax reform is a common goal of President-Elect Trump and house republicans. How, when, and to what extent tax law is enacted is unknown. However, some of the most significant proposed changes are to the transfer tax regime and they are worth discussing.

Repeal of the estate tax

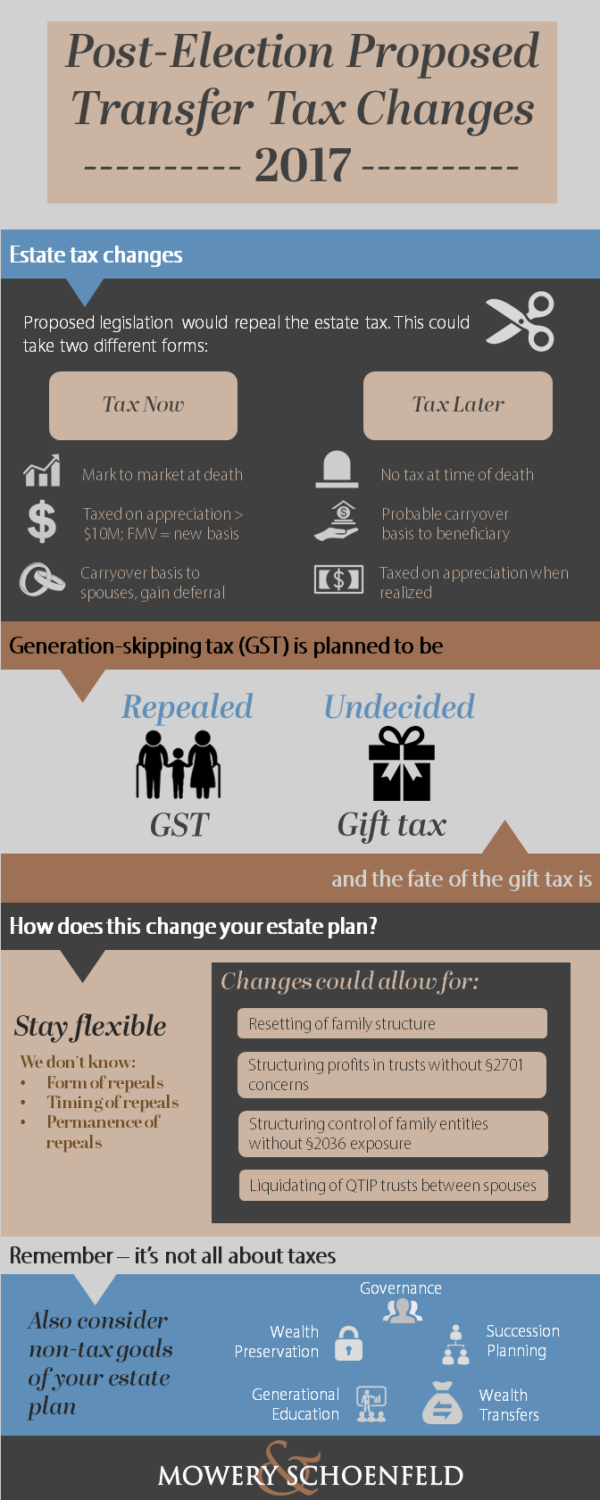

One substantial change being discussed is the repeal of the estate tax. There are a few ways this could play out, with the two prevalent options being:

- Repeal the estate tax and apply a carryover basis for assets help in the estate; this would most likely eliminate the long-standing tradition of the "step-up" in basis.

- Comparable to Canada's deemed-disposition rules, the second option would apply "mark-to-market" taxation on inherited assets in excess of $10M at death, taxing the difference between the fair market value of the assets and the decedent's basis in them. In this option, the fair market value of the asset would then be the beneficiaries' new basis.

There are discussions of allowing spouses to take a carryover basis in the property under the provisions of the second option, deferring gains until both spouses are deceased.

Generation-skipping transfer tax (GST) and gift taxes

The proposed changes would also repeal the generation-skipping transfer tax. Interestingly, there has been little to no discussion yet on how or if there would be any changes to the gift tax.

What's the plan?

Because we don't know what form the repeals will take, or whether they'll extend beyond the next administration, it's important to structure your estate plan to be as flexible and responsive as possible. These changes represent opportunities to take advantage of some key planning strategies, including:

- The ability to reset your family structure without technical impediments

- The ability to structure profits in trusts without §2701 gift concerns

- The ability for senior family members to take control of family entities without §2036 exposure

- The ability to liquidate QTIP trusts between spouses to take advantage of a higher combined basis upon death

These proposed changes also affect Proposed §2704 regs, which threatened to change how closely held businesses were valued and triggered a lot of estate planning earlier this fall. If you've recently updated your estate plan in response to these proposed regs, check with your advisor to find out whether your plan is still advantageous and effective.

State estate taxes

Remember, it's not only the Federal estate tax that you should incorporate into your planning; many states impose a separate estate tax which may not be affected by the federal repeals. It is safe to assume that states with inheritance taxes (e.g. Kentucky, Pennsylvania) would continue to collect these taxes.

Other considerations

Although it's easy to get caught up in the whirlwind of transfer tax discussions, you should remember that estate tax avoidance isn't the only reason to establish a solid estate plan. In addition to minimizing your tax liability, you should consider the following when planning for your estate:

- Proper governance structure

- Succession planning

- Asset protection and long-term wealth preservation

- Education and involvement of the next generation

- Lifetime wealth transfers to children and descendants

You can trust Mowery & Schoenfeld with your estate planning and tax service needs.