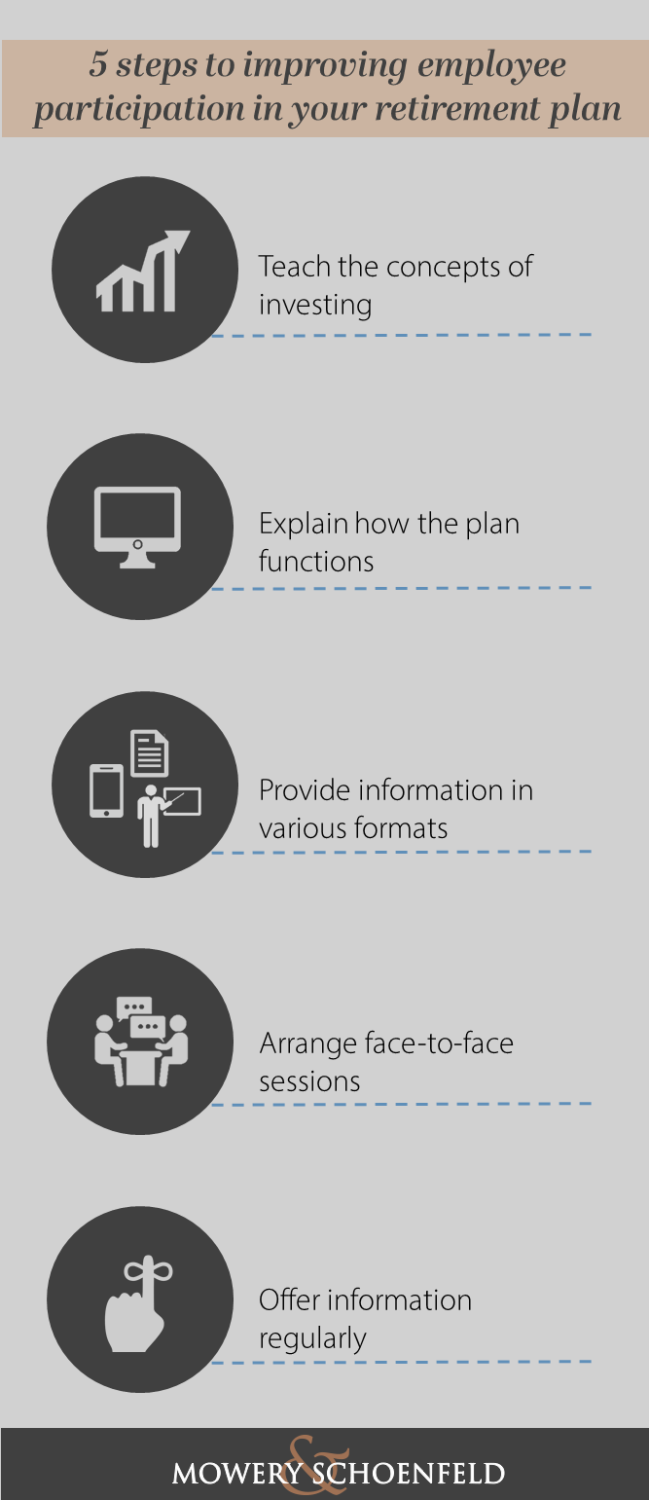

As we approach the end of the year, it's time to start thinking about (and talking to your employees about) retirement planning and the tax savings that are still available. Employers who offer retirement savings plans are already helping their workforces, but not all employees take advantage of these plans. And many who do still don't contribute enough to retire comfortable or to maximize the tax savings allowed by the law. As a business owner, you can help your employees even more - and drive plan participation - by taking five easy steps:

1. Teach them about the general concepts of investing

Many employers are unfamiliar with basic economic and investing concepts. Offer instruction on concepts such as:

- Compounding growth

- Tax implications of different types of savings plans

- How much they need to save to reach a certain sum at retirement

Providing such information can help your employees make informed decisions about their options.

2. Explain how the plan functions

For instance, do they need to enroll in the plan, or are they automatically enrolled? Once enrolled, how do they decide how much to contribute and how to allocate their money among different investments?

3. Provide information in various formats

Webinars or other online communication methods will resonate with some employees, while others will prefer printed material. By offering a mix of options, you'll likely be effective in reaching different segments of your workforce.

4. Arrange face-to-face sessions

Even if your business offers printed and electronic materials, in-person sessions can go a long way in helping employees understand the plan. These sessions also provide an opportunity to reinforce the value of a retirement plan as part of the employee's overall compensation package. If one-on-one sessions are impractical, consider smaller groups.

5. Offer information regularly

Providing consistent education is a great way to remind employees of the value of their retirement savings plans.

Remember, employees aren't the only ones who benefit from proper retirement savings education. As participation increases, plan fees may diminish, freeing up cash for you to either offer additional benefits or reinvest in the company.